09 May Warren Buffett’s Greatest Investment: How to Lead Like a Gardener Planting a Forest

🪴 True legacy isn’t built in spreadsheets—it’s grown in the hearts of those who carry it forward.

🔁 Missed the previous edition of the newsletter? Here’s the Seed That Started It All:

In our first issue, “Succession Planning Isn’t Just for CEOs”, we debunked the myth that succession is only for boardrooms. Whether you’re leading a business, team, or family, you’re already in the legacy game. The edition shared three urgent wake-up calls:

- Succession is about momentum, not just titles.

- Legacy planning isn’t optional—even for solo entrepreneurs.

- Wealth without wisdom is a ticking time bomb. 👉 If you haven’t yet, click here and go back and read it—it sets the foundation for what you’re about to explore below.

🌳 The Buffett Blueprint Begins Here…

What if your greatest legacy was something you’d never live to see?

Warren Buffett built one of history’s most enduring business empires by thinking in centuries— not quarters.

Imagine planting a tree that won’t reach full height for 100 years. You’ll never sit in its shade, but generations will. Warren Buffett didn’t just plant a tree; he cultivated an entire forest.

And his secret? He spent decades watering saplings, not just pruning his own branches.

Let’s pull back the curtain on how a man who mastered money also mastered the art of letting go—and what you can steal from his playbook.

🧠 From Paper Routes to Planting Seeds: Buffett’s Unconventional Growth Formula

At 11, most kids are trading baseball cards. Warren Buffett was buying stocks.

At 11, most kids are trading baseball cards. Warren Buffett was buying stocks.

At 13, he filed his first tax return, deducting his bicycle as a work expense for his paper route.

This wasn’t just hustle—it was the first sign of a mind hardwired to play infinite games.

But here’s what most miss: Buffett’s real genius wasn’t stock picks—it was pattern recognition.

He noticed early that true wealth grows like oak trees: slowly, steadily, through storms and seasons.

🍎 The “Apple Seed” Moment

In 2016, Buffett shocked Wall Street by betting $1 billion on Apple.

Analysts scoffed—“He doesn’t understand tech!”

But Buffett saw what others missed: iPhones weren’t gadgets, they were digital appendages—creating lifetime customer value.

📈 Today, that $1B seed is a $160B oak in Berkshire’s forest.

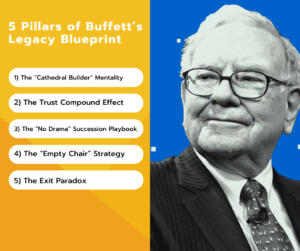

🏛️ The 5 Pillars of Buffett’s Legacy Blueprint (And How to Copy Them)

- The “Cathedral Builder” Mentality

“Someone’s sitting in the shade today because someone planted a tree long ago.” — Buffett

Buffett transformed a failing textile mill into an $800B ecosystem by asking:

“What would this look like in 50 years?”

How to Apply This:

- Hire your future CEO today.

In 2018, Buffett didn’t just name Greg Abel a successor—he gave him four years of “shadow apprenticeship.” - 🔧 Actionable Takeaway: Identify two potential successors. Give them quarterly “CEO-for-a-Day” projects.

- The Trust Compound Effect

Buffett’s annual letters read like notes to a friend. In 2009, he wrote:

“I’ve pledged to eat my own cooking… My family has 99% of their net worth in Berkshire.”

Contrast: When Wells Fargo’s fake accounts scandal broke, their stock crashed 30%.

Meanwhile, Buffett’s Bank of America stake doubled—because trust compounds over decades.

- The “No Drama” Succession Playbook

Most transitions feel like Game of Thrones finales. Buffett made his feel like a Sunday barbecue.

The 20-Year Handoff:

- 2003: Abel joins Berkshire Energy

- 2018: Quietly named VP (groomed as heir)

- 2021: Buffett casually references him as successor

- 2024: Seamless transition unfolds

🪢 Metaphor Alert: Buffett treated succession like a relay race—not a baton drop, but a 20-lap jog where both runners overlapped.

- The “Empty Chair” Strategy

Every board meeting had two symbolic empty seats:

- One for “Shareholder”

- One for “Future Generation”

A visible reminder: leadership is stewardship.

🪑 Steal This: Add a “Legacy Chair” to your next strategy meeting. Ask:

“What would the version of us in 2050 want us to do?”

- The Exit Paradox

Buffett’s retirement was a masterclass in timing:

- Retired at 93 (while sharp and respected)

- During a bull market (not a crisis)

- After 5 years of Abel co-piloting

⚠️ Cautionary Tale: Jack Welch retired in 2001, but lingered as a “shadow CEO.”

GE’s value fell 80% in 20 years.

🎼 The Jobs Contrast: From Solo Maestro to Symphony Conductor

Young Steve Jobs was a brilliant soloist. But orchestras need conductors.

Young Steve Jobs was a brilliant soloist. But orchestras need conductors.

His 1985 ouster exposed Apple’s overreliance on one man.

Post-Pixar Jobs came back wiser:

- Mentored Tim Cook for 8 years

- Created Apple University to pass on wisdom

- Designed products (like the iPhone) that thrive without him

📊 iPhone revenue in 2023: $200B

Lesson: Legacy isn’t about being irreplaceable—it’s about building replaceable systems.

🧰 Your Legacy Toolkit: 3 Immediate Actions

- Start a “Future CEO” Journal

Every Friday, jot down one insight for your successor. After 6 months, gift it to them. - Run a “Buffett Stress Test”

Ask: If I disappeared tomorrow, what would break? Who’s ready to step in? - Host “Reverse Mentoring” Dinners

Let your youngest team members teach you.

Their world is the future you’re building for.

🧱 The Final Word: Be the Architect, Not the Tenant

Buffett’s greatest return wasn’t 20% annual gains—it was cultural compound interest.

He built a house future generations could redecorate, but whose foundation remains unshakable.

As you make your next leadership decision, ask Buffett’s favorite question:

“Do I want to be remembered for what I controlled—or what I unleashed?”

The clock’s ticking.

🌱 What seeds will you plant today?

📢 Share Your Take:

👉 Reply with your #1 takeaway—or share this with a fellow leader who’s building for the long game.

#LegacyLeadership #SuccessionGardening #BuffettBlueprint #WarrenBuffett

#BerkshireHathaway #SuccessionPlanning #GregAbel #LongTermThinking #EnduringLegacy